bank of canada prime rate

Get quick access to data on exchange rates money markets inflation interest rates and bond yields. This is lower than the long term average of 724.

1 day agoRBC TD first banks to hike prime interest rate after Bank of Canada decision.

. By Staff The Canadian Press Posted March 2 2022 405 pm. Bank of Canada Interest Rate Announcement January 26 2022 James Orlando CFA Senior Economist 416-413-3180. The Investment Industry Regulatory Organization of Canada IIROC will start publishing for informational purposes only the 1- and 3-month transaction based BA rates on the same date.

MONTREAL March 02 2022 GLOBE NEWSWIRE -- Laurentian Bank of Canada TSX. The prime rate also known as the prime lending rate is the annual interest rate Canadas major banks and financial institutions use to set interest rates for variable loans and lines of credit including variable-rate mortgages. Reporters will not be able to attend in person.

1 day agoThe increase in the prime rate which variable-rate mortgages are tied to will take effect on Thursday the lender said. Rather we have responsibilities for Canadas monetary policy bank notes financial system and funds management. The target rate upon which prime rate and variable-rate mortgages are priced has been at 025 since March 2020 when the Bank cut rates at an emergency meeting at the start of the pandemic.

1 day agoRoyal Bank of Canada Toronto-Dominion Bank and Bank of Montreal said on Wednesday they will raise their prime lending rates for the first time since October 2018 after the Bank of Canadahiked. The rate announcement press release and the Monetary Policy Report will be available at 1000 ET on the Banks website. 2 days agoThe Bank of Canada has raised its key interest rate for the first time since slashing the benchmark rate to near-zero at the start of the COVID-19 pandemic in a.

2009 Longest period of no change. The prime rate has remained at 245 since it was cut three times in a row in early 2020 when the pandemic first hit Canada. All Bank of Canada exchange rates are indicative rates only obtained from averages of aggregated price quotes from financial institutions.

At 1100 ET Tiff Macklem Governor of the Bank of Canada and Carolyn Rogers Senior Deputy Governor will hold a press conference via teleconference only. The prime rate in Canada is currently 245. Get ready Canada.

The era of historically low- interest rates could be coming to a quick end. 2 days agoBank of Canada likely to hike key interest rate Wednesday The Bank of Canada is expected to boost its trendsetting policy rate which has been parked at. This would bring the overnight rate to 050 double the current level.

Above we have predicted that the Bank of Canadas Target Overnight Rate will remain at 025 for 2021 and rise to 050 in 2022. In the first quarter the Bank of Canada BoC is forecast to raise rates by 25 basis points bps. 2015 Since the Bank of Canada started inflation targeting in 1991 the average Bank of Canada rate hike cycle has lasted 229 percentage points as measured from the trough to the peak as of September 2018.

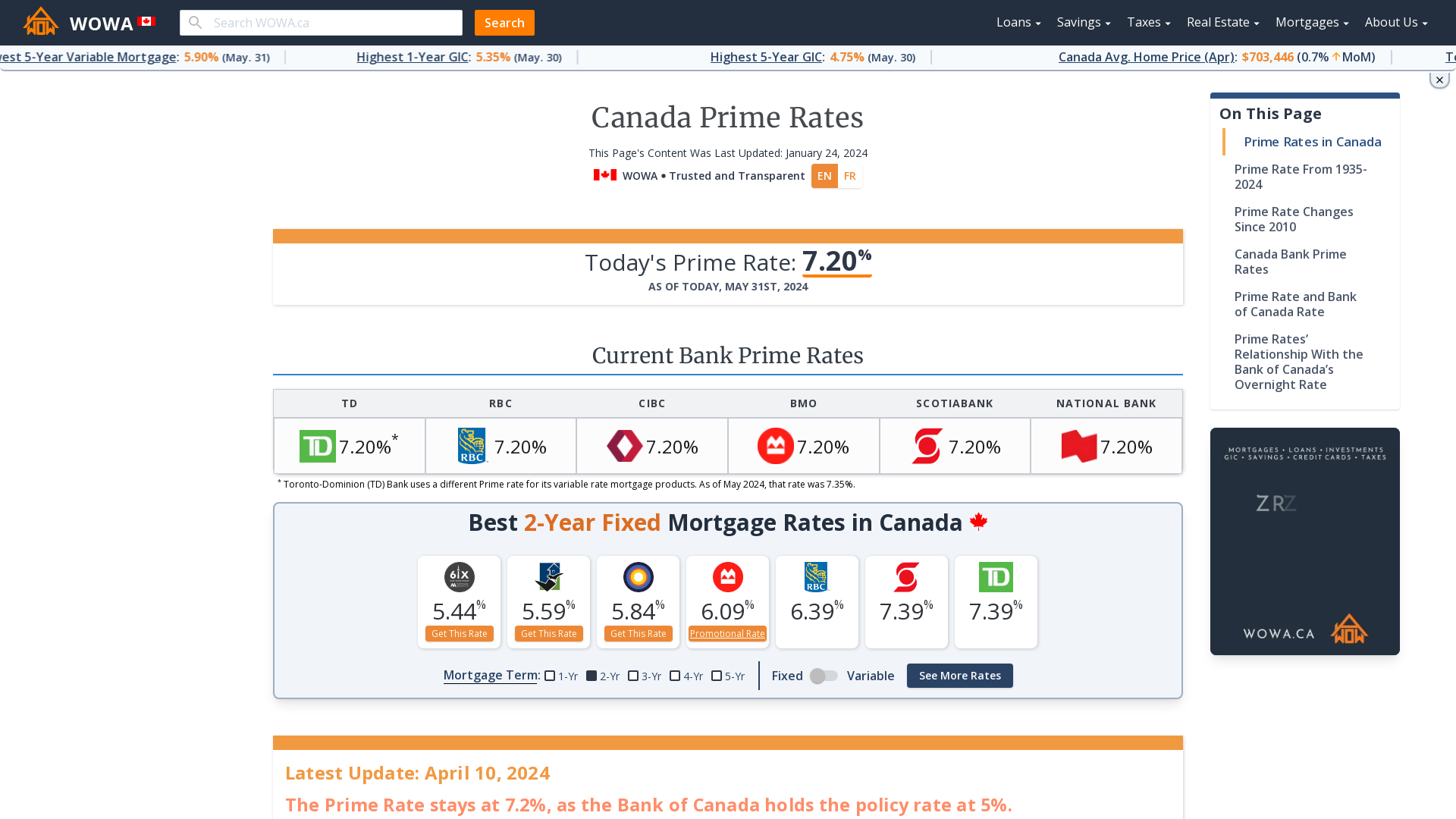

The Bank of Canada which sets the country. The prime interest rate fell from its previous level of 395 as the bank of Canada accelerated cuts to its overnight rate in order to boost the economy and minimize the financial impact of the pandemic. Each financial institution sets its own prime rate as a function of its cost of funding which in turn is influenced by the target for the overnight rate set by the Bank of Canada.

LB increases its prime lending rate by 25 basis points from 245 to 270 effective March 3 2022. Canada Prime Rate is at 245 compared to 245 last week and 245 last year. 2 days agoThe Bank of Canada raised its key interest rate target for the first time since slashing its benchmark rate to its rock-bottom level at the start of the COVID-19 pandemic.

Bank of Canada Interest Rates. 1 day agoRoyal Bank of Canada will increase its prime rate to 27 from 245 Canadas biggest bank said on Wednesday after the central bank. We are not a commercial bank and do not offer banking services to the public.

For details please read our full Terms and Conditions. Since then the economy has. The Bank of Canada.

On January 26 the Bank of Canada will make its next rate decision. The Bank of Canada is the nations central bank. Bank of Canada Interest Rate Forecast for the Next 5 Years.

From 2023 onwards the outlook is less certain and highly dependent on global macroeconomic factors. The central banks overnight interest rate sets the tone for the prime rates offered by banks. Prime Rate Advertising Disclosure.

2 days agoThe Bank of Canada cut its key interest rate to the emergency level of 025 in March 2020 in an effort to help the economy weather the economic shock of the pandemic. The prime rate or prime lending rate is the interest rate a financial institution uses as a base to determine interest rates for loan products. We explain what changes in the policy rate mean for you.

As of January 2019 the Bank of Canada will no longer publish the daily weekly or monthly prime commercial paper CP or bankers acceptance BA rates. In total the bank has forecast five interest rate hikes in 2022. 1 day agoRBC TD and BMO lift prime rates to 27 after Bank of Canada hike Back to video The higher prime rate which variable-rate mortgages are tied to will rise to 27 per cent from 245 per cent and come into effect on Thursday the three lenders said.

Our principal role as defined in the Bank of Canada Act is to promote the economic and financial welfare of Canada. Updated April 23rd 2021. National Bank sees interest rates doing a steep climb this year and they expect it to start within weeks.

Heres a look at what some economists and analysts are saying in the lead-up to one of the most highly anticipated Bank of Canada meetings in years.

Canada S Surge Of Variable Rate Mortgages Are Forecast To See Costs Double Desjardins Better Dwelling

Success Story Of Netflix Services Netflix Netflix Service Netflix International

Pin En Area De Toronto Canada Familia

Gbpusd Has The Primary Double Zigzag Ended Orbex Forex Trading Blog Forex Trading Pattern Forex

The Omnipresent Future Of Ecb Unconventional Monetary Policy Is Here May 19th 2018 Monetary Policy Omnipresent Policies

Worm S Eye View Of Black Building Amazingphotos Amazingphotography Greatphotos Awesomepictures Awesomeima Black Building Architecture Photo Architecture

One Three Five Year Fixed Mortgage Rate Mortgage Interest Rates Mortgage Rates Mortgage

What Is The Prime Rate In Canada Get Current Rate Rate History

Pace Of Bank Of Canada Rate Hikes Could Be Interrupted Stephen Poloz Says Bank Canada Interrupting

If Words Like Prime Rate Home Equity Line Of Credit Or Variable Mortgage Rate Aren T In Your Day To Day Vocab Mortgage Rates Mortgage Refinance Mortgage

Consumer Confidence Slides Off 17 Year High Bloomberg Business Conference Board Confidence

U S Investor Optimism Rises Again Hits 17 Year High Strong Hand Optimism Optimistic